Sex matters in the City

The Financial Conduct Authority is the regulator for the financial services sector in the UK. They are proposing to set new rules to encourage big companies to have more “female” directors on their boards.

The new regulations would cover over 1000 firms, employing tens of millions of people, and the measures they take are intended to influence broader diversity and inclusion policies.

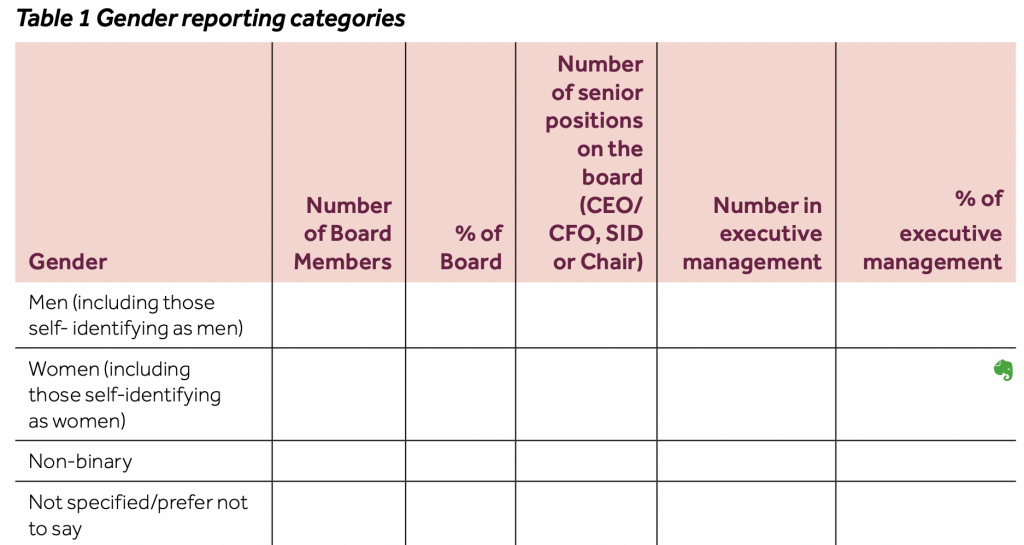

In an astonishing move for a financial watchdog that is supposed to be prudent, open and transparent the FCA proposal is not to accurately count the numbers of male and female directors according to their legal (or biological) sex, but instead to invent an entirely new set of categories that have no basis in the law:

Sex Matters response

We have sent in a response to the consultation rejecting this approach.

We argue that the FCA should follow the law. They should:

- Amend the regulation to be clear that it concerns the balance between the two sexes on boards

- Provide a reporting format with records straightforwardly whether directors are male or female (or prefer not to say)

- Not take up “non-binary” as a category. Parliament has not agreed this. It is not the FCA’s role to redefine the sexes.

- Decide whether they are collecting data on legal sex, or biological sex and publish the justification and reasoning for it.

- Publish an equality impact assessment that assesses the impact of their choices on people with protected characteristics as defined in the Equality Act 2010,

We point out their proposed approach is not in line with the Equality Act 2010, the Census, the advice of the Office for Statistics Regulation, the Data Protection Act 2018, the Companies Act 2006, or even the Gender Recognition Act 2004.

Like the “X Passports” case this seems to be another effort at radical reform making an end-run around parliamentary democracy.

How much has Stonewall had a hand in this?

In its 60 page consultation document (released with a 12 week consultation period) the financial regulator does not even make the case for why it proposes abandoning straightforward, accurate data on the number of male and female directors and instead wants to count the number of people performing femininity. It does not explain “non-binary at all”. It just expects this to be a done deal.

Why have has the financial regulator rolled out the rainbow carpet for this?

Could it be linked to the role of Stonewall Chair Sheldon Mills on the FCA Executive Committee?

Could it be because the FCA (along with the Bank of England) are Stonewall Champions? (proudly at number 59 on the Stonewall Index)?

The FCA staff handbook includes the usual traces of Stonewall’s advice; a maternity leave and breastfeeding policy that awkwardly avoids the words “woman” or “mother”, and talk of “sex assigned at birth” and of “gender identity”. And yet for all the effort the FCA has put into rainbow washing, staff chats reveal statements like “‘I’ve never worked in such an unhappy place” and “belief and trust in ExCo [the executive committee] is non-existent.” The Chair has just stepped down amid plummeting morale.

In February 2021 one of our supporters put in a freedom of information request about the FCA’s dealings with Stonewall. She has followed up several times and so far they have written back three times saying that they are still processing the request. We think it is high time they came clean.

Write to the FCA to tell them that it is not their job to try to impose Stonewall law on us through the financial markets (you can respond to the consultation by 20 October [email protected] or write to CEO Nikhil Rathi )